How Does Interest Rates Affect Bond Prices . bonds have an inverse relationship with interest rates: When rates rise, the price of existing bonds may fall, and vice versa. A bond's coupon rate is the. A bond's yield is the discount rate that links the bond's cash flows to its current dollar price. price and interest rates. bond prices and interest rates move in opposite directions, so when interest rates fall, the value of fixed income investments rises, and when interest rates. — key takeaways. — when interest rates rise, bond prices generally fall, making existing bonds less attractive compared to newly issued bonds with. The price investors are willing to pay for a bond can be significantly affected by prevailing.

from dxosyfjua.blob.core.windows.net

A bond's coupon rate is the. — when interest rates rise, bond prices generally fall, making existing bonds less attractive compared to newly issued bonds with. A bond's yield is the discount rate that links the bond's cash flows to its current dollar price. When rates rise, the price of existing bonds may fall, and vice versa. bonds have an inverse relationship with interest rates: — key takeaways. bond prices and interest rates move in opposite directions, so when interest rates fall, the value of fixed income investments rises, and when interest rates. The price investors are willing to pay for a bond can be significantly affected by prevailing. price and interest rates.

How Does The Interest Rate Affect Bonds at Hilda Bartlett blog

How Does Interest Rates Affect Bond Prices price and interest rates. bonds have an inverse relationship with interest rates: price and interest rates. — key takeaways. The price investors are willing to pay for a bond can be significantly affected by prevailing. — when interest rates rise, bond prices generally fall, making existing bonds less attractive compared to newly issued bonds with. bond prices and interest rates move in opposite directions, so when interest rates fall, the value of fixed income investments rises, and when interest rates. When rates rise, the price of existing bonds may fall, and vice versa. A bond's coupon rate is the. A bond's yield is the discount rate that links the bond's cash flows to its current dollar price.

From dxosyfjua.blob.core.windows.net

How Does The Interest Rate Affect Bonds at Hilda Bartlett blog How Does Interest Rates Affect Bond Prices bond prices and interest rates move in opposite directions, so when interest rates fall, the value of fixed income investments rises, and when interest rates. A bond's yield is the discount rate that links the bond's cash flows to its current dollar price. — key takeaways. The price investors are willing to pay for a bond can be. How Does Interest Rates Affect Bond Prices.

From www.slideserve.com

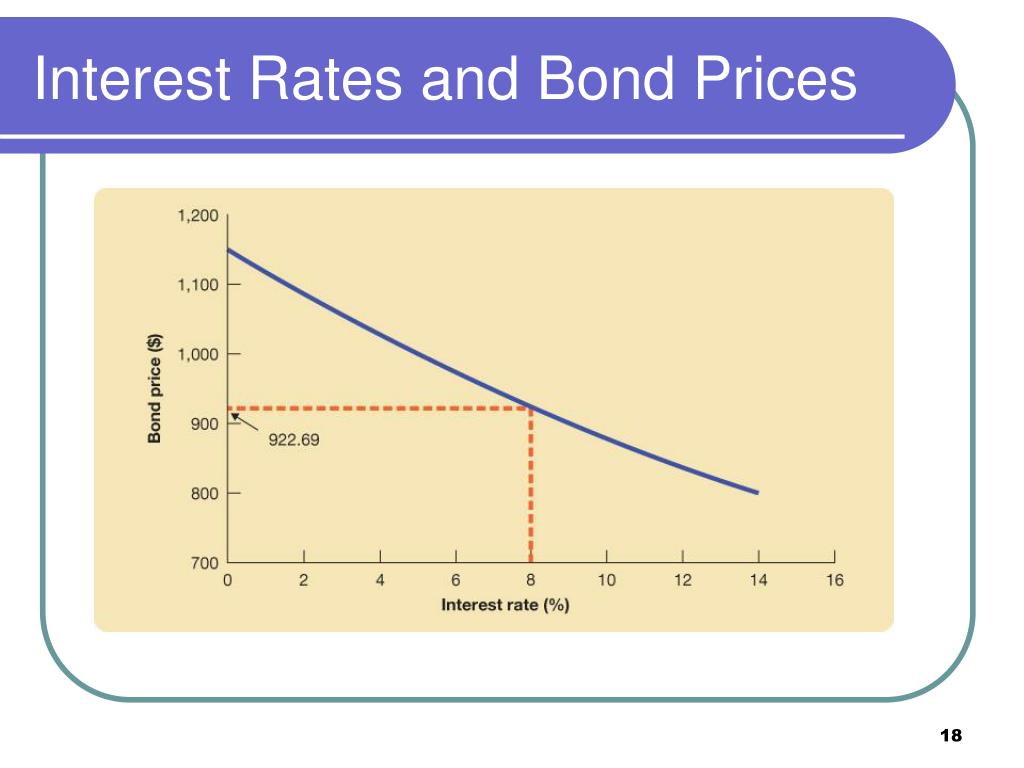

PPT Money Demand, the Equilibrium Interest Rate, and Policy PowerPoint Presentation How Does Interest Rates Affect Bond Prices — key takeaways. — when interest rates rise, bond prices generally fall, making existing bonds less attractive compared to newly issued bonds with. A bond's coupon rate is the. A bond's yield is the discount rate that links the bond's cash flows to its current dollar price. The price investors are willing to pay for a bond can. How Does Interest Rates Affect Bond Prices.

From speedtrader.com

What You Need To Know About How Stock and Bond Markets Interact How Does Interest Rates Affect Bond Prices The price investors are willing to pay for a bond can be significantly affected by prevailing. — key takeaways. A bond's coupon rate is the. A bond's yield is the discount rate that links the bond's cash flows to its current dollar price. bond prices and interest rates move in opposite directions, so when interest rates fall, the. How Does Interest Rates Affect Bond Prices.

From toplevelbooks.com

How interest rates affect your investments and bond prices How Does Interest Rates Affect Bond Prices — key takeaways. A bond's coupon rate is the. — when interest rates rise, bond prices generally fall, making existing bonds less attractive compared to newly issued bonds with. price and interest rates. The price investors are willing to pay for a bond can be significantly affected by prevailing. bonds have an inverse relationship with interest. How Does Interest Rates Affect Bond Prices.

From dxosyfjua.blob.core.windows.net

How Does The Interest Rate Affect Bonds at Hilda Bartlett blog How Does Interest Rates Affect Bond Prices A bond's yield is the discount rate that links the bond's cash flows to its current dollar price. bond prices and interest rates move in opposite directions, so when interest rates fall, the value of fixed income investments rises, and when interest rates. A bond's coupon rate is the. When rates rise, the price of existing bonds may fall,. How Does Interest Rates Affect Bond Prices.

From penobscotfa.com

Bond prices and interest rates. Tell me again how that works? Penobscot Financial Advisors How Does Interest Rates Affect Bond Prices The price investors are willing to pay for a bond can be significantly affected by prevailing. A bond's coupon rate is the. — when interest rates rise, bond prices generally fall, making existing bonds less attractive compared to newly issued bonds with. bond prices and interest rates move in opposite directions, so when interest rates fall, the value. How Does Interest Rates Affect Bond Prices.

From www.linkedin.com

How do Changes in Interest Rates Affect Bond Prices How Does Interest Rates Affect Bond Prices A bond's coupon rate is the. The price investors are willing to pay for a bond can be significantly affected by prevailing. A bond's yield is the discount rate that links the bond's cash flows to its current dollar price. When rates rise, the price of existing bonds may fall, and vice versa. — key takeaways. price and. How Does Interest Rates Affect Bond Prices.

From saylordotorg.github.io

Demand, Supply, and Equilibrium in the Money Market How Does Interest Rates Affect Bond Prices The price investors are willing to pay for a bond can be significantly affected by prevailing. bonds have an inverse relationship with interest rates: A bond's yield is the discount rate that links the bond's cash flows to its current dollar price. A bond's coupon rate is the. bond prices and interest rates move in opposite directions, so. How Does Interest Rates Affect Bond Prices.

From darrowwealthmanagement.com

How Do Interest Rates Affect Bonds? Relationship Between Rates, Bond Prices and Yields How Does Interest Rates Affect Bond Prices A bond's yield is the discount rate that links the bond's cash flows to its current dollar price. When rates rise, the price of existing bonds may fall, and vice versa. A bond's coupon rate is the. — when interest rates rise, bond prices generally fall, making existing bonds less attractive compared to newly issued bonds with. bond. How Does Interest Rates Affect Bond Prices.

From goldenpi.com

How does Inflation Affect Bond price? Relationship Between Bond Prices and Interest Rates How Does Interest Rates Affect Bond Prices price and interest rates. The price investors are willing to pay for a bond can be significantly affected by prevailing. A bond's yield is the discount rate that links the bond's cash flows to its current dollar price. A bond's coupon rate is the. When rates rise, the price of existing bonds may fall, and vice versa. bond. How Does Interest Rates Affect Bond Prices.

From dxosyfjua.blob.core.windows.net

How Does The Interest Rate Affect Bonds at Hilda Bartlett blog How Does Interest Rates Affect Bond Prices A bond's coupon rate is the. bonds have an inverse relationship with interest rates: The price investors are willing to pay for a bond can be significantly affected by prevailing. When rates rise, the price of existing bonds may fall, and vice versa. — key takeaways. A bond's yield is the discount rate that links the bond's cash. How Does Interest Rates Affect Bond Prices.

From www.investopedia.com

Understanding Treasury Yield and Interest Rates How Does Interest Rates Affect Bond Prices bonds have an inverse relationship with interest rates: When rates rise, the price of existing bonds may fall, and vice versa. A bond's yield is the discount rate that links the bond's cash flows to its current dollar price. — key takeaways. A bond's coupon rate is the. price and interest rates. — when interest rates. How Does Interest Rates Affect Bond Prices.

From saylordotorg.github.io

Demand, Supply, and Equilibrium in the Money Market How Does Interest Rates Affect Bond Prices When rates rise, the price of existing bonds may fall, and vice versa. bonds have an inverse relationship with interest rates: A bond's coupon rate is the. price and interest rates. The price investors are willing to pay for a bond can be significantly affected by prevailing. bond prices and interest rates move in opposite directions, so. How Does Interest Rates Affect Bond Prices.

From www.linkedin.com

How Interest Rates affect Bond Prices How Does Interest Rates Affect Bond Prices — key takeaways. — when interest rates rise, bond prices generally fall, making existing bonds less attractive compared to newly issued bonds with. When rates rise, the price of existing bonds may fall, and vice versa. price and interest rates. bond prices and interest rates move in opposite directions, so when interest rates fall, the value. How Does Interest Rates Affect Bond Prices.

From financialdesignstudio.com

Managing Interest Rate Risk in your Bond Investments How Does Interest Rates Affect Bond Prices — key takeaways. — when interest rates rise, bond prices generally fall, making existing bonds less attractive compared to newly issued bonds with. The price investors are willing to pay for a bond can be significantly affected by prevailing. A bond's yield is the discount rate that links the bond's cash flows to its current dollar price. . How Does Interest Rates Affect Bond Prices.

From wealthinsights.metrobank.com.ph

The impact of interest rates on bond prices Metrobank Wealth Insights How Does Interest Rates Affect Bond Prices When rates rise, the price of existing bonds may fall, and vice versa. A bond's coupon rate is the. — when interest rates rise, bond prices generally fall, making existing bonds less attractive compared to newly issued bonds with. bonds have an inverse relationship with interest rates: A bond's yield is the discount rate that links the bond's. How Does Interest Rates Affect Bond Prices.

From www.slideserve.com

PPT Various Measures of Interest Rates Relationship of Market Interest Rates to Bond Prices How Does Interest Rates Affect Bond Prices When rates rise, the price of existing bonds may fall, and vice versa. A bond's coupon rate is the. — key takeaways. A bond's yield is the discount rate that links the bond's cash flows to its current dollar price. bond prices and interest rates move in opposite directions, so when interest rates fall, the value of fixed. How Does Interest Rates Affect Bond Prices.

From www.educba.com

Interest Formula Calculator (Examples with Excel Template) How Does Interest Rates Affect Bond Prices The price investors are willing to pay for a bond can be significantly affected by prevailing. — when interest rates rise, bond prices generally fall, making existing bonds less attractive compared to newly issued bonds with. A bond's coupon rate is the. price and interest rates. bond prices and interest rates move in opposite directions, so when. How Does Interest Rates Affect Bond Prices.